Beyond Four Walls: How Home Quality Impacts Racial Wealth and Health Gaps

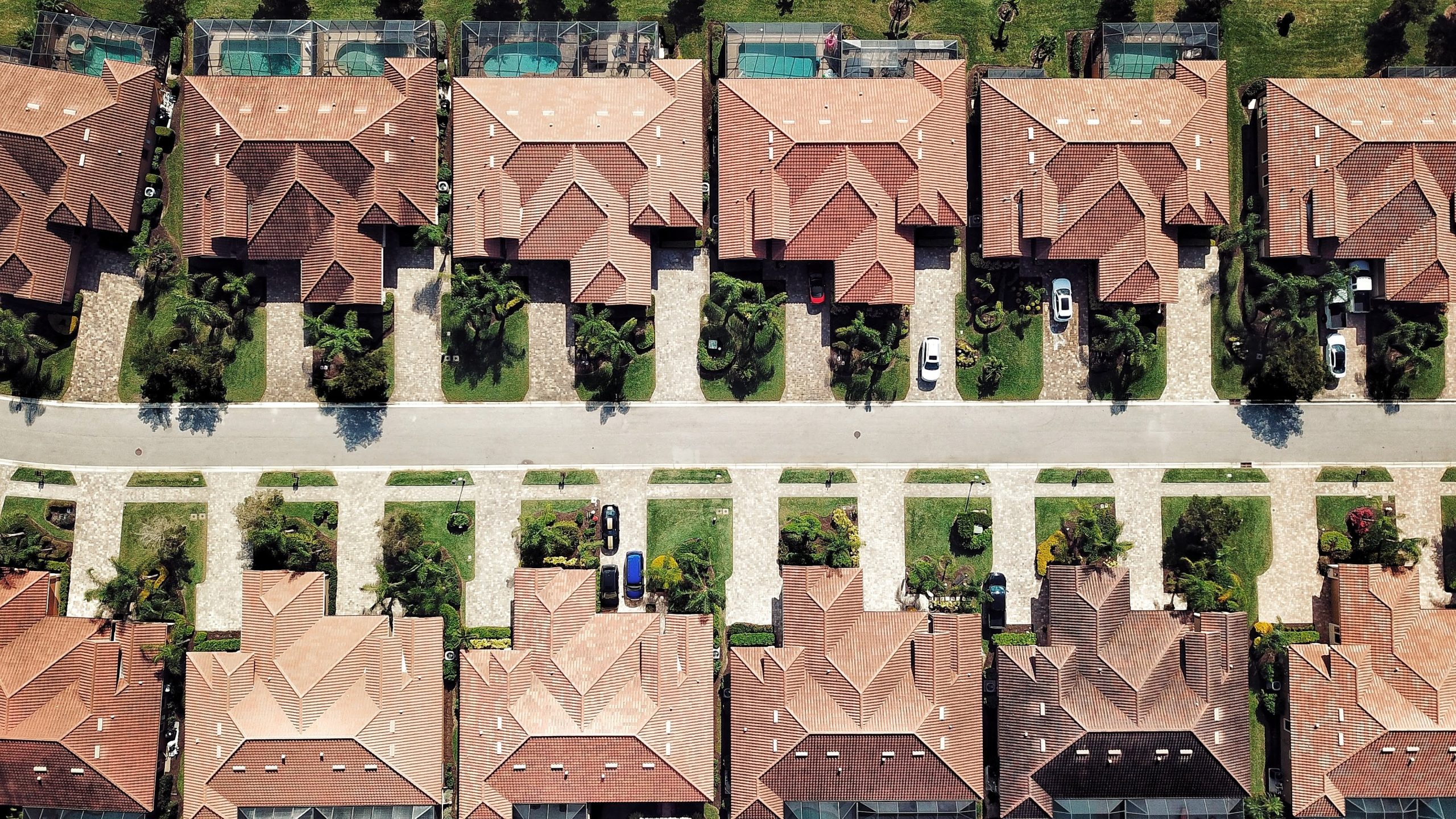

Homeownership is one of the most—if not the—most important factors in building intergenerational wealth for families in the United States. Decades of disinvestment have led Black Americans to face systemic discrimination at nearly every step of the home-buying process, resulting in a staggering 30 percent Black homeownership gap. This racial chasm for homeownership remains a [...]

Community Housing Capital Announces Closing of a $25 Million New Markets Tax Credit (NMTC) Allocation for Affordable Housing

The Smith NMTC Associates team is excited to announce the successful closing of a $25 million New Markets Tax Credit (NMTC) allocation transaction for Community Housing Capital (CHC). CHC deployed the allocation to four NeighborWorks organizations located in Arizona, Florida, Maryland, and Indiana. A Community Development Financial Institution (CDFI) and Community Development Entity (CDE), and [...]

Webinar for CDEs

REGISTER TODAY for NMTCs for Affordable Homeownership: The CDE Perspective Monday, April 22, 2024 11 a.m. CDT Affordable homeownership is one of the most pressing needs of our time—join us to learn how CDEs can use their NMTC allocation for homeownership projects! Topics Covered Past use of NMTCs for affordable homeownership How to use your NMTC [...]

Advancing Latino Homeownership in the United States

Despite decades-long housing inequities, Latino households are projected to drive 70 percent of net homeownership gains through 2040. These projections are correlated to the fast growth of the Latino population in the U.S., with many aging into their prime homebuying years in the next two decades. However, Latino homeowners face significant obstacles on their path [...]

Smith NMTC Announces The Housing Partnership Network’s (HPN) $21 Million NMTC Allocation Provided to 3 HPN Member Organizations

A total of 81 homes are planned to be built by nonprofit developers in California, Georgia, and Kentucky, thanks to an $8 million New Markets Tax Credit (NMTC) loan each to Self-Help Enterprises (SHE) in Visalia, CA and NeighborWorks Columbus in Columbus, GA, and a $5 million NMTC loan to The Housing Partnership, Inc. (HPI) [...]

Operation Food Search to Expand Headquarters with $11 Million New Markets Tax Credit Allocation

The Smith NMTC Associates team is thrilled to announce the closing of an $11 million New Markets Tax Credit-supported loan for Operation Food Search, Inc. (OFS) to grow its operations. The hunger-fighting nonprofit will increase its programming and impact with the renovation of its Overland, Missouri headquarters to be completed later this year. The St. [...]

Our Year in Review: Over $83 Million in New Markets Tax Credits (NMTCs)

As we hit the ground running in 2024, we want to reflect on the past year and celebrate our organization’s achievements—made possible by the dedication of our partners. Deepening Our Impact on Residential Homeownership In 2023, our team facilitated six closings deploying $83 million in New Markets Tax Credits (NMTCs) allocation to 13 nonprofit housing [...]

Smith NMTC Announces Closing of $16M NMTC Allocation to Support Four Habitat For Humanity Projects

The Smith NMTC Associates team is excited to announce the closing of a $16 million New Markets Tax Credit (NMTC) transaction in support of four different Habitat for Humanity affiliates: Tacoma/Pierce County Habitat for Humanity, Habitat for Humanity of East Jefferson County in Washington, Habitat for Humanity of the Charlotte Region, Inc., and Twin Cities [...]

Home Insurance Deserts and Climate Change: A New Challenge

This summer, State Farm announced that it would not issue any new homeowner policies in the state of California due to the rapidly growing wildfire risk. Within days, Allstate followed suit, confirming that it would stop issuing California homeowner policies due to the high cost of home repairs and reinsurance premiums. These are just two [...]

Black and Hispanic Real Estate Developers and Barriers to Success

While inequities in the housing market remain severe, another inequity that exists under the surface contributes to the racial homeownership inequality: The representation crisis among real estate developers across the United States. Real estate development companies are disproportionately white: Of the 112,000 real estate development companies in the country, just 1,000 of them are owned [...]

Blogpressablealiassolutionscom2024-04-11T14:42:56-04:00